unemployment tax credit refund 2021

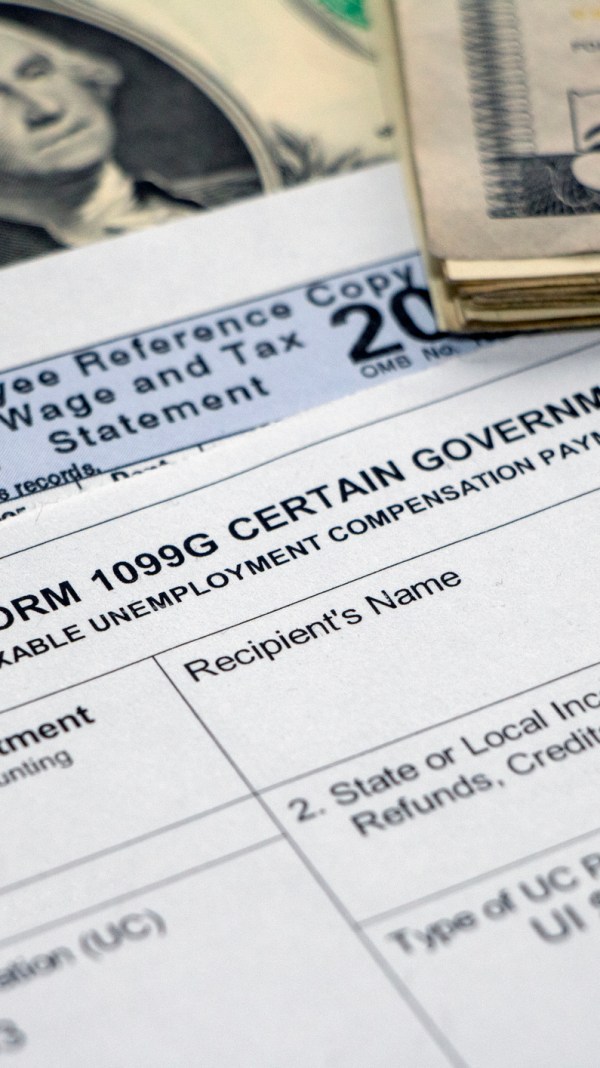

This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only. You did not get the unemployment exclusion on the 2020 tax return that you filed.

How To Claim Your 10 200 Unemployment Tax Break If You Already Filed Taxes Stock Market Online Trading Online Stock Trading

The IRS reported that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust taxable income amounts based on the exclusion for unemployment compensation from previously filed income tax returns.

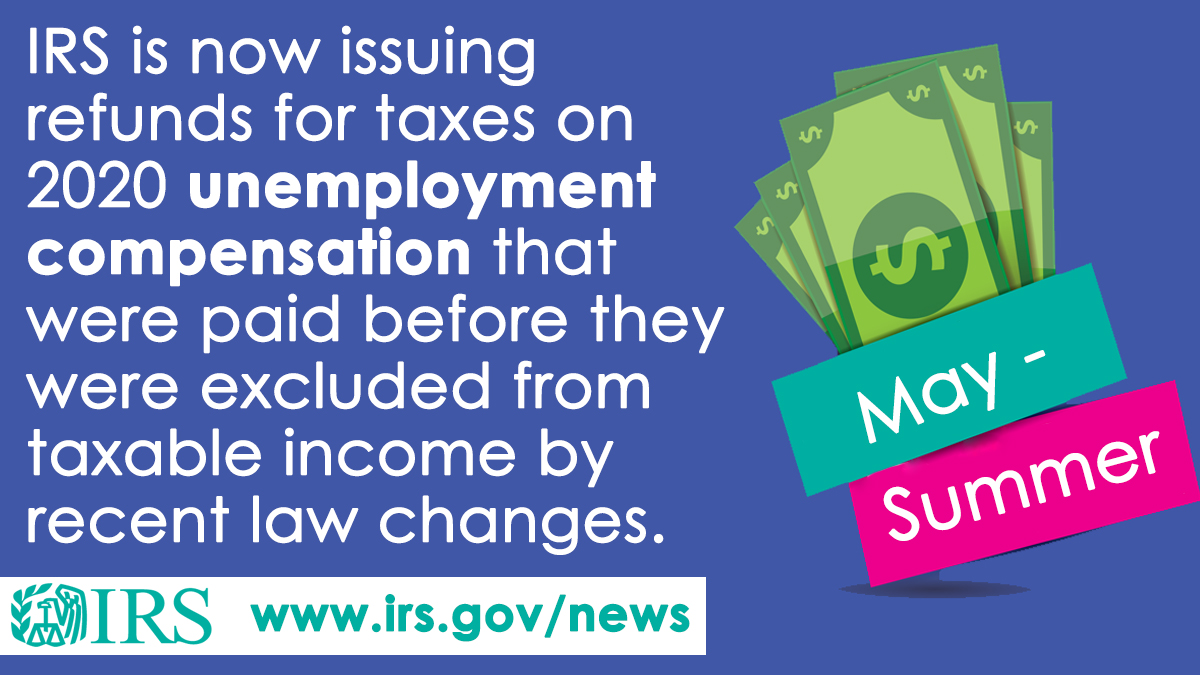

. Unemployment benefits are not tax-free in 2021 so far. WASHINGTON The Internal Revenue Service will begin issuing refunds this week to eligible taxpayers who paid taxes on 2020 unemployment compensation that the recently-enacted American Rescue Plan later excluded from taxable income. The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American.

Thats money that could go to cover what income taxes you owe or possibly lead to a bigger federal income tax refund. If you received unemployment benefits last year you may be eligible for a refund from the IRS. IR-2021-111 May 14 2021.

The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. Initially offering up to 2000 per qualifying child this years version sees an 80 bump to 3600 per child under the age of 6 If you have previously received part of the Child Tax Credit in advance you should have received a letter from the IRS in January. This isnt the refund amount.

TAS Tax Tip. WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of unemployment compensation paid in 2020.

IR-2021-159 July 28 2021. The exemption which applied to federal taxes meant that unemployment checks. While taxes had been waived on up to 10200 received in unemployment for those making less than 150000 in 2020 -- the first year of the pandemic -- that was only temporary relief and no such.

The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only. 1 You will get an additional federal income tax refund for the unemployment exclusion if all of the following are true. There are other factors that may reduce your WBR like whether you are working part-time or collecting a pension.

You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000. Congress hasnt passed a law offering. Congress has bolstered the Child Tax Credit for 2022.

President Joe Biden signed the pandemic relief law in March. If your modified AGI is 150000 or more. Amounts over 10200 for each individual are still taxable.

During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. Will 2021 unemployment be taxed. In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is up to 10200 per spouse.

Unpaid child support could also keep you from getting the money. File unemployment tax return. The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414.

Ad Pay 0 to File all Federal Tax Returns No Upgrades 100 Accurate. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. IR-2021-71 March 31 2021.

The IRS identified over 10 million taxpayers who filed their tax returns prior to the. As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the tax year 2020 were not subject to federal tax. In order to have qualified for the.

The IRS has identified 16. This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only. 1222 PM on Nov 12 2021 CST.

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. Another thing the American Rescue Plan did was exempt up to 10200 of unemployment compensation from taxes for the 2020 tax year. Households who are waiting for unemployment tax refunds can check the status of the payment Credit.

Yes for 2021 and ONLY 2021 if you collect unemployment your income will be considered as 133 of the Federal Poverty Level for purposes of calculation the Premium Tax Credit regardless of your actual income. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020.

If you are married each spouse receiving unemployment compensation may exclude up to 10200 of their unemployment compensation. To be eligible for Unemployment Insurance benefits in 2021 you must have earned at least 220 per week during 20 or more weeks in covered employment during the base year period or you must have earned at least 11000 in total. More 2021 unemployment compensation exclusion adjustments and refunds in some cases coming.

On 10200 in jobless benefits were talking about 1020 in federal taxes that would have been withheld. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. Report unemployment income to the IRS.

When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. The 10200 amount 20400 for joint filers is how much 2020 unemployment compensation doesnt count as income. This tax break was applicable.

Like all tax refunds it can be seized if you have unpaid taxes outstanding federal or state. Jobless workers who collected benefits the first year of the. You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7.

The first 10200 in benefit income is. Getty What are the unemployment tax refunds. July 29 2021 338 PM.

Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. The Child Tax Credit Is Back and Better Than Ever. Some tax credits are refundable meaning that if the amount of your credit is more than the amount of your taxes due you will receive the difference back from the government in the form of a refund.

The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person.

Irsnews On Twitter Irs Is Correcting Tax Returns For Unemployment Compensation Income Exclusion The First Adjustments Are For Single Taxpayers Who Had The Simplest Tax Returns This Could Result In Refunds For

2021 Unemployment Benefits Taxable On Federal Returns Cbs8 Com

This Privacy Focused Browser Stops Websites Tracking You Even Better Than Chrome Does Brave Browser Blocking Websites Browser

What To Do With Your Pre Cooked Tikoy Swirlingovercoffee Tikoy Done With You Egg Words

No A Tax Break On 2021 Unemployment Benefits Isn T Available

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Benefits And Child Tax Credit H R Block

Indian Shares End Flat Private Lenders Fall While Reliance Metal Stocks Gain Private Lender Financial Stocks Initial Public Offering

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Tax Season Is Here Don T Expect A Refund For Unemployment Benefits

Centuryaccounting Posted To Instagram Do You Know The One Thing We Insist Every Taxpayer Should Do E File Their Ret Tax Refund Federal Income Tax Income Tax

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

When Is The Tax Return Deadline For 2022 In Germany N26

We Are Accepting New Clients Schedule An Appointment Today Heights 406 969 2760 West End 406 894 2050 Taxes Payro Tax Quote Business Cartoons Salon Quotes

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Unemployement Benefits Will I Get A Tax Refund For This Benefit Marca